List Of Investment Apps In Nigeria

-

Cowrywise

Cowrywise is a popular investment app that offers a variety of investment options, including stocks, bonds, ETFs, and cryptocurrencies. It also has a built-in robo-advisor that can help you choose the right investments for your goals.

-

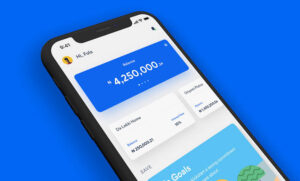

Piggyvest

Piggyvest is another popular investment app that offers a variety of savings and investment products. With Piggyvest, you can save money for specific goals, such as a down payment on a house or a new car. You can also invest your money in stocks, bonds, and ETFs.

-

Bamboo

Bamboo is an investment app that allows you to invest in US stocks and ETFs. It offers a variety of features, including fractional shares, which allow you to invest in a stock without having to buy the entire share.

-

Trove

Trove is an investment app that allows you to invest in Nigerian stocks and ETFs. It also offers a robo-advisor that can help you choose the right investments for your goals.

-

Chaka

Chaka is an investment app that allows you to invest in Nigerian stocks and ETFs. It also offers a variety of features, including margin trading, which allows you to borrow money from Chaka to buy more stocks.

-

Carbon

Carbon is an investment app that allows you to invest in a variety of asset classes, including stocks, bonds, ETFs, cryptocurrencies, and real estate. It also offers a variety of features, including auto-investing, which allows you to invest a fixed amount of money each month.

-

Pillow Fund

Pillow Fund is an investment app that allows you to invest in stablecoins. Stablecoins are cryptocurrencies that are pegged to a fiat currency, such as the US dollar. This means that the value of a stablecoin is relatively stable, which makes it a good option for investors who are looking for a low-risk investment.

-

GetEquity

GetEquity is an investment app that allows you to invest in Nigerian stocks. It also offers a variety of features, including fractional shares, which allow you to invest in a stock without having to buy the entire share.

Features and Benefits of Investment Apps

Investment apps offer a number of features and benefits that can make them a convenient and easy way to invest your money. Some of the key features and benefits of investment apps include:

- Ease of use: Investment apps are designed to be easy to use, even for first-time investors. They typically have a user-friendly interface that makes it easy to find the information you need and make investments.

- Low fees: Investment apps often have low fees, which can save you money on your investments.

- Variety of investment options: Investment apps offer a variety of investment options, so you can find the right ones for your goals.

- Automated investing: Some investment apps offer automated investing features, which can help you invest your money on a regular basis.

- Portfolio tracking: Investment apps track your investments and provide you with reports on your performance.

How to Choose the Right Investment App for You

There are a number of factors to consider when choosing an investment app. Some of the most important factors include:

- Your investment goals: What are you hoping to achieve with your investments? Are you looking to grow your wealth over the long term, or are you looking to make quick profits?

- Your risk tolerance: How much risk are you comfortable taking with your investments? Some investment

How do I get started with an investment app?

To get started with an investment app, you will need to create an account and verify your identity. Once you have created an account, you can deposit money into your account and start investing.

What investment options are available on investment apps?

The investment options available on investment apps vary depending on the app. Some of the most common investment options include:

- Stocks: Stocks are shares of ownership in a company. When you buy stocks, you are essentially buying a piece of the company.

- Bonds: Bonds are loans that you make to a company or government. When you buy a bond, you are essentially lending money to the company or government.

- ETFs: ETFs are baskets of stocks or bonds that trade on an exchange like stocks. ETFs offer a way to invest in a variety of assets with a single purchase.

- Cryptocurrencies: Cryptocurrencies are digital or virtual tokens that use cryptography for security. They are decentralized, meaning they are not subject to government or financial institution control.

How much money do I need to start investing?

The amount of money you need to start investing depends on the investment app and the investment options you choose. Some investment apps allow you to start investing with as little as $50. Other investment apps require a minimum investment of $100 or more.

What are the fees associated with investment apps?

The fees associated with investment apps vary depending on the app. Some investment apps charge no fees, while others charge a small fee for each trade. It is important to compare the fees of different investment apps before you choose one.

How safe are investment apps?

Investment apps are generally considered to be safe. However, it is important to do your research and choose an app that is regulated by a financial institution. You should also make sure that you understand the risks involved in investing before you start.

How can I learn more about investment apps?

There are a number of resources available to help you learn more about investment apps. You can read articles and blog posts, watch videos, or take online courses. You can also talk to a financial advisor who can help you choose the right investment app for your needs.

What are the benefits of using an investment app?

There are a number of benefits to using an investment app. Some of the most common benefits include:

- Convenience: Investment apps make it easy to invest your money from anywhere. You can make trades, track your investments, and get updates on your performance all from your smartphone or tablet.

- Low fees: Investment apps often have low fees, which can save you money on your investments.

- Variety of investment options: Investment apps offer a variety of investment options, so you can find the right ones for your goals.

- Automated investing: Some investment apps offer automated investing features, which can help you invest your money on a regular basis.

- Portfolio tracking: Investment apps track your investments and provide you with reports on your performance.

What are the risks of using an investment app?

There are a few risks associated with using an investment app. Some of the most common risks include:

- Market volatility: The value of your investments can go up and down, and you could lose money.

- Fraud: There is always the risk of fraud when you invest your money online.

- Cybersecurity: Your personal information could be at risk if you use an investment app that does not have strong cybersecurity measures in place.

It is important to understand the risks involved in investing before you start using an investment app. You should also do your research and choose an app that is reputable and has a good track record.