Nigerian Banks offer USSD Codes to make financial transactions easier. You can perform different banking tasks on your mobile without needing an app or internet connection. This article will explore the USSD code for Nigeria’s leading banks: GTB, FCMB, UBA, Wema, Fidelity Bank, and more.

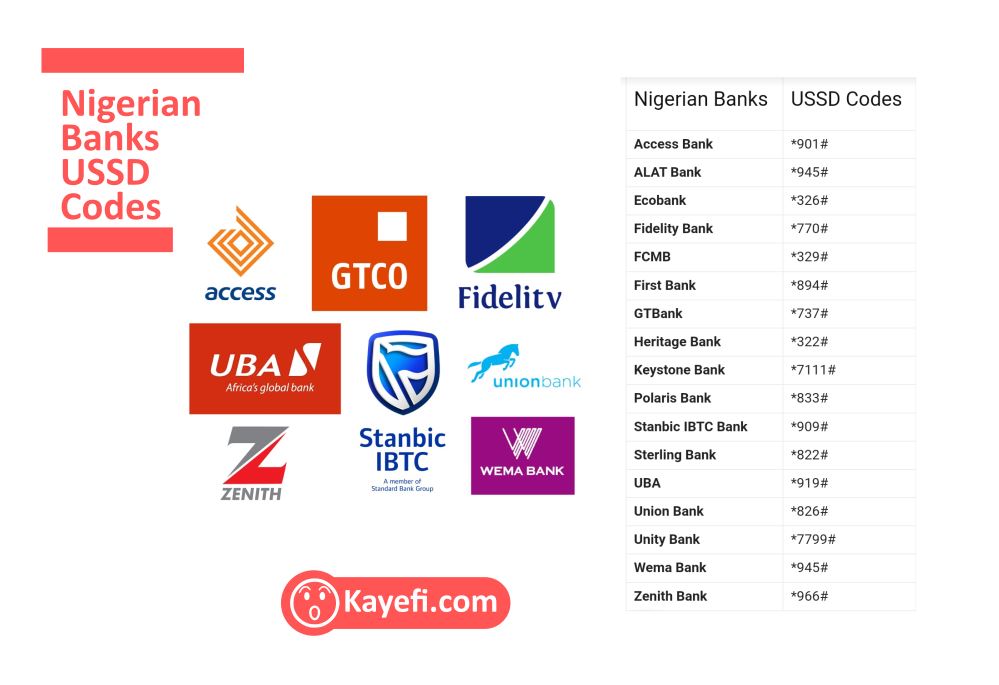

Nigerian Banks USSD Codes

USSD is an acronym for “unstructured service data.” It’s been around since the 1990s. The GSM Association developed it, which is the trade association behind many of the cell phone standards around the world.

USSD banking is a mobile banking service that uses SMS to provide financial services such as bill payment, recharge of airtime, transfers, etc. USSD banking is a convenient and cost-effective way to access financial services without an internet connection.

USSD is particularly attractive for financial services because it’s inclusive – it can reach customers who have older phones, don’t use smart phones, or do not have internet access through their cell provider. These customers are the largest market in developing countries (bank users), making USSD a valuable resource for those banks. The banks in Nigeria have not been left behind in the USSD challenge.

Most traditional and digital bank in Nigeria has adopted personalized USSD codes in order to provide seamless financial services. This allows more people to have access to financial services without having the hassle of using the Internet.

Let’s see how the Nigerian Banks USSD Codes codes function.

What is the USSD Banking System?

A USSD shortcode creates a two-way communication between the customer and the bank. The responses are then displayed in a screen prompt (pop-up) with menus and ‘tied’ service options that guide the user towards the services they require. You will need to activate your USSD code using your chosen phone number on your phone in order to use it for any bank transactions. You must be registered with a bank or have an existing account before you can use their financial services.

To authorize transactions, you would need to create a 4- or 5-digit PIN. This PIN will also act as a barrier to stop fraudsters or impersonators from accessing your bank account. Your PIN, like any other security breach can be compromised if someone gets their hands on your ATM card, or other personal information. You should always be cautious with your mobile phone, card and personal information. You should also avoid storing your PIN in your mobile or using a PIN which is easily guessable, such as your date of birth or house number.

USSD banking has many benefits for both the bank and user. Here are a few of the advantages of USSD banking.

USSD Banking: Benefits

- Easy Account Opening: USSD Banking offers convenience and comfort with little or no additional charges. USSD banking allows you to open an account without any hassle, as long as your phone is connected with your network provider. There is no need for long forms or a minimum balance in order to open a bank.

- Access to Unlimited Financial Services: You can use USSD Banking to send money, pay bills, and check your account balance. You can use USSD banking at any time.

- No internet needed: Unlike mobile banking or internet banking, which incur additional fees for internet access, USSD banking is a free way to enjoy banking services via your mobile phone. You only need a mobile phone that works to get started.

- No physical bank stress: Aside from periodic maintenance that may result in service downtimes and USSD banking, you save time and reduce stress. No need to wait in line at any bank for transactions to be carried out on your account. This allows you to save time and do other things.

List of Nigerian Banks USSD Codes

Here is a List of Nigerian Banks and Their USSD Banking Shortcodes.

The different Nigerian Banks and their USD/Shortcodes for USSD Banking

| 1. GTBank | *737# |

| 2. ALAT Bank | *945# |

| 3. Ecobank | *326# |

| 4. FCMB | *329# |

| 5. Fidelity Bank | *770# |

| 6. First Bank | *894# |

| 7. Access Bank | *901# |

| 8. Heritage Bank | *745# |

| 9. Keystone Bank | *7111# |

| 10. Polaris Bank | *833# |

| 11. Sterling Bank | *822# |

| 12. Stanbic IBTC Bank | *909# |

| 13. UBA | *919# |

| 14. Union Bank | *826# |

| 15. Zenith Bank | *966# |

| 16. Wema Bank | *945# |

| 17. Unity Bank | *7799# |

Utilizing USSD Codes for Efficient Banking

USSD codes offer a combination of convenience, speed and accessibility. These codes eliminate the need for internet services and provide a reliable alternative to everyday banking. These codes allow customers to perform seamless financial transactions, such as paying bills, transferring money, and checking their balances.

It’s best to begin with simple transactions, such as checking your balance or purchasing airtime, to get used to the commands. Once users gain confidence, they can begin to use more complex commands like bill payment and funds transfer.

UBA (United Bank for Africa).

UBA’s USSD codes can be derived from *919# and make banking easier:

- Account Balance: Dial 919*00# for your account balance.

- Fund transfer: To transfer money, use *919*Amount*Recipient’s Account Number#.

- Airtime Purchase: Charge your phone by dialing *919*Amount#.

- Bill Payment: Pay your bills using *919*30*Biller code*Amount#.

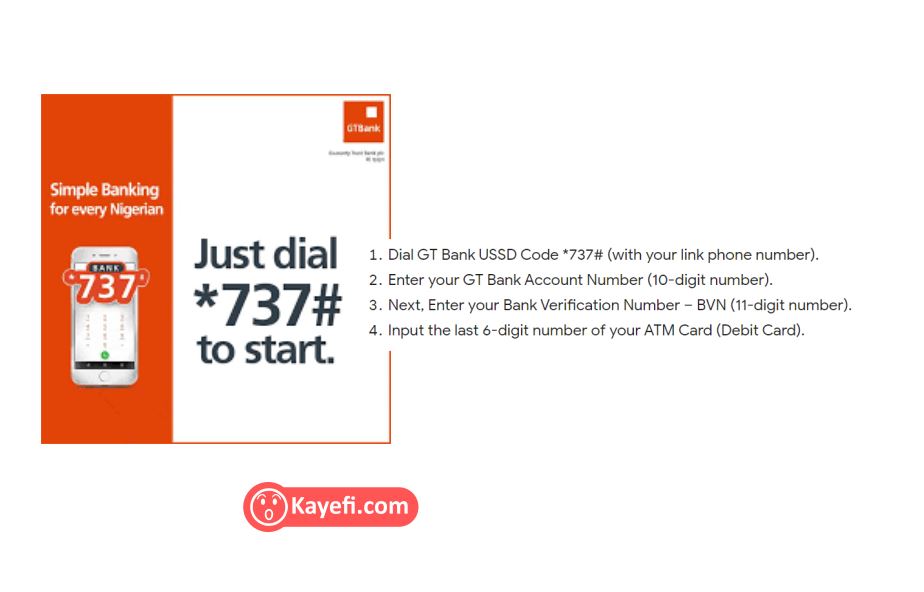

GTB USSD Codes (Guaranty Trust Bank).

GT Bank has a customer-centric focus. You can do the following with GT Bank’s USSD code that is generated from *737#:

- To check your account balance, dial *737*6*1#.

- Transfer funds: Send money to other GT Bank accounts by dialling *737*1*Amount*Recipient’s Account Number#.

- Recharge your phone . To top up your mobile with airtime, dial *737*Amount#.

- Bill payments: Pay utility bills and subscriptions using *737*50*Amount*Unique Reference Number#.

- Open a GT Bank account If you are new to GT Bank and would like to open a GT Bank account, please dial *737*0#.

FCMB (First City Monument Bank).

FCMB provides a variety of USSD Services starting with the root code*329#. These include:

- Check your account balance: Dial 329*0# for your account balance.

- Transfer money: To send funds, dial *329*Amount*Recipient’s Account Number#.

- Top-up your airtime : Recharge with *329*Amount#.

- Bill Payments – Use *329*Amount*Merchant code# to pay your bills.

Fidelity Bank

Fidelity Bank USSD services simplify banking tasks with the base code *770#.

- Account Balance: Dial 770*0# for your account balance.

- Send money: Transfer funds by dialing *770*Recipient’s account number*Amount#.

- Recharge your airtime: Add more credit to your phone by dialing *770*Amount#.

- Bill Payment: Pay your bills using *770*Merchant code*Amount#.

Last thoughts on Nigerian Banks USSD Codes including GTB, FCMB, UBA, Zenith Bank, Fidelity Bank, and More USSD Codes

These USSD codes will help you unlock the convenience of banking in the digital age.

The introduction of USSD codes by Nigerian banks marks a significant advancement in the accessibility of banking services. These codes not only provide convenience but also ensure that customers can carry out essential banking operations anytime and anywhere. Whether it’s checking balances, transferring funds, purchasing airtime, or paying bills, the USSD codes from GTB, FCMB, UBA, and Fidelity Bank have truly revolutionized the way customers interact with their banks, making everyday banking a breeze.

As technology continues to evolve, we can expect these services to expand further, offering even more features that cater to the dynamic needs of modern banking customers. For anyone looking to simplify their financial transactions, embracing these USSD services is a step in the right direction.